May 11, 2007 — Aitkin County Court Administrator. Bonnie Lecocq ... Civil,State & Federal Constitutional Rights, Whistle Blower Title 12 & 31 state, allege ... yr mortgage with V.S. Bank HUD Sharons Card quitam's findlaw , Sharon's Husband. James R ... Gun Lake Property, but because of the Threats Demand for EMS is.

Get free access to the complete judgment in GUN LAKE ASS'N v. ... and relators appealed the planning commission's decision to the Aitkin County Board ... On appeal to this court from the county board's denial of the appeal from the planning ...

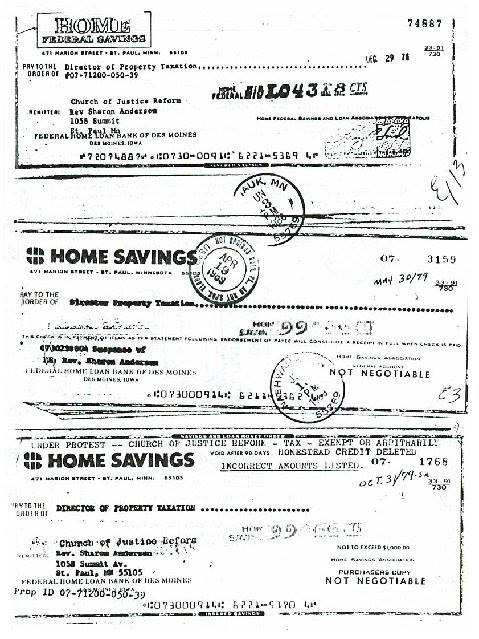

Missing: Sharons Federal

AOLfiles - Sharon4Anderson - Google Sites

sites.google.com › site › sharon4anderson › Home › aolfiles

Sep 5, 2007 — Sharon MN Homegrown,VA Widow,Political,Consumer Advocate,Private AG,

.jpg)